Transnational cola drink companies

Teaching the world to burp? Job done

Coca-Cola at a nutrition conference in Mexico (left); sharing the Christmas

market in the US with Pepsi (right). And what about that Time cover?

The news team reports: Those concerned with recent forms of economic globalisation may forget that Coca-Cola and Pepsi-Co had penetrated virtually all markets, from cities to remote villages in all continents, some decades ago. A cover of Time magazine is shown above. The words underneath say 'World & Friend. Love that piaster, that lira, that tickey [small change] and that American way of life'. This was 1950. The text inside said that the 'gentle burps' caused by the drink could be heard 'amidst the bustle of Parisian sidewalk cafes' and 'the tinkling of Siamese temple bells'. The writer continued 'To find something as thoroughly native American hawked in half a hundred languages on all the world's crossroads from Arequipa to Zwolle' was disconcerting – 'like reading Dick Tracy in French'. James Farley, then boss of the company's foreign operations, said that round the world, goodwill to the US was stoked by Coke, and would eventually embrace all nations in 'a brotherhood of peace and progress'.

Making you burp, and making you fat, too

Time has moved on. Coca-Cola and PepsiCo are now responding to the overwhelming evidence that their products, including their soft drinks (known as soda in the US) are a major cause of overweight and obesity, initially in countries like the US where consumption is highest. Thus, in the US consumption of carbonated soft drinks, of which Coca-Cola and Pepsi-Cola are far and away the market leaders, now amounts to over 50 gallons per person per year. Consumption, and also levels of obesity, more than doubled between 1997 and 2006.

Association Council member Philip James, President of the International for the Study of Obesity, says, as quoted on this website in December last year: 'The evidence that fast food and soft drinks are drivers of the pandemic of childhood overweight and obesity is very impressive. Only the industry and their apologists are arguing'. Association founder member Barry Popkin adds: 'From 1978 to 2006, calories from non-alcoholic drinks in the US have increased by 219 calories per person per day. Nationally, that amounts to almost all the additional intake of daily energy by all Americans over this period. Increasing the price of all 2-litre sugar-sweetened beverages by $US1 a unit, would have the effect of reducing 124 calories every day. This is the most effective way we have to halt weight increases and the escalating diabetes problem'. So how are Coca-Cola and PepsiCo responding, as next month's UN Summit on the prevention and control of non-communicable diseases approaches?

The transnational united front

Muhtar Kent, Coke, born Ayvalik, Turkey, 1952 (left) and Indra Nooyi, Pepsi, born Chennai, India, 1954 (right) doing the global business this year at Davos

Here in the pictures above are the chief executive officers of Coca-Cola and of Pepsi-Co, Muhtar Kent and Indra Nooyi, in action in Davos this year during the annual meeting of the World Economic Forum. Their current annual remuneration is believed to be around $US 25 million and $US 20 million, respectively. These are small potatoes compared with the total rewards given to senior investment bankers, but transnational food and drink processors are able to offer attractive salaries, bonuses, options and pension packages to well-qualified people from the public sector, including the UN and governments and their agencies.

Coca-Cola and Pepsi-Co do battle for global market share of the carbonated and other soft drink market (see Box 2, below). But together with other transnational food and drink corporations, whose turnover matches that of the gross national product of middle-size countries, their main interests are in common, and they hunt as members of a pack. As one example, ten giant corporations have made a formal alliance, whose statements include pledges to reduce advertising and marketing to children worldwide. There is as yet little if any evidence that this voluntary action is actually resulting in a reduction of overall spend in all media, or in any change in child overweight and obesity.

One of the shared strategies of the transnational food and drink processors, is to shift global food supplies and dietary patterns away from whole and minimally processed food, made into meals with the use of culinary ingredients, towards ultra-processed branded ready-to-eat (or drink) fatty, sugary or salty 'fast' and 'convenient' products. These have the most added economic value, and are most profitable. With 'classic' Coke and Pepsi as the originators, together with Nestlé infant formula, followed by McDonald's, these branded products are the industry's equivalent of Mickey Mouse and Donald Duck, Hollywood movies, Nike and Adidas, Fox News, and more recently multi-media entertainment franchises such as Power Rangers.

The shared purpose of the transnational food and drink industry heavy hitters who share the WEF stages with current and previous heads of state, and eminences such as Pepsi advisor Henry Kissinger, is to ensure that international agreements and national legislation leave them free to maximise their global sales and profits. Part of their rationale is that this will increase capital flow, and increase the turnover of money and thus 'development' in low-income countries. They also indicate, just as James Farley stated over half a century ago, that their business will enrich Asian and African countries, and will make the world a happier and more harmonious place. In effect, they act like they have taken over the responsibilities of elected governments.

All this is a context for the remarkable fact that the range of diseases identified as non-communicable for next month's UN Summit, does not include obesity. This follows sustained and well-resourced pressure from and behalf of conflicted industry and its representative organisations, among which is the World Economic Forum.

The road-map most travelled

Most market analysts agree that US consumption of carbonated soft drinks, which is now around 50 gallons per person (including children) per year, having risen ten-fold since the 1940s, has now peaked. Current consumption overall amounts to around 7 per cent of total calories in the US diet. For teenagers the amount is almost twice that, at 13 per cent. As indicated in Box 2, below, sales of cola drinks in the US are now static or slowly dropping.

Late in 2009 Muhtar Kent announced Coke's '2020 Vision and Road-Map For Winning Together', extracts of which are contained in Box 1, below. The masterplan was – and is – to double revenue and sales in a decade. Really? With stagnant sales in the US, and a pledge not to advertise or market to under 12 year-olds?

Box 1

Coke's 2020 vision road-map

November 16, 2009. The Coca-Cola Company Provides Roadmap for Achieving 2020 Vision at Analyst and Investor Event. This is how it was heralded

The Coca-Cola Company is hosting an Investor and Analyst event on November 16 and 17, titled 'A Growing World of Refreshment', in Atlanta to discuss the Company's '2020 Vision and Roadmap for Winning Together.' Senior company management – along with select bottling system leaders – are discussing the global and local forces that are shaping its business today and for the next decade.

The '2020 Vision and Roadmap for Winning Together' builds upon the Company's mission to refresh the world and inspire moments of optimism and happiness, while creating value for shareowners and making a difference across the globe. The Company will discuss a number of key goals as part of its '2020 Vision and Roadmap for Winning Together' based on the '6 Core P's' of its vision:

- Profit: More than double system revenue by 2020 while increasing system margins.

- People: Be a great place to work.

- Portfolio: More than double servings to over three billion a day by 2020 and be #1 in the nonalcoholic ready-to-drink business in every market and every category that is of value to us.

- Partners: Be the most preferred and trusted beverage partner.

- Planet: Be the global leader in sustainable water use and industry leadership. in packaging, energy and climate protection.

- Productivity: Manage people, time and money for the greatest effectiveness.

'We worked with our bottling partners to create a 2020 Vision that is designed for action and guided by goals that will stretch us and enable us to continue to grow our business', said Muhtar Kent, chairman and chief executive officer, The Coca-Cola Company. 'Working hand-in-hand with our great bottling partners, we are building a unified and aligned system equipped for long-term sustainable growth. With this roadmap as our guide, I am confident that we will usher in a new era of winning for the Coca-Cola system'.

Mr. Kent continued 'We know that winning in 2020 and beyond is going to require new capabilities, new models and new innovations. We are laser-focused on targeting the right consumers with fully integrated global marketing campaigns that work on many levels, across many geographies and cultures, and leverage a rich variety of media and channels. To target aging and affluent consumers globally, we are actively exploring new ingredients, new functionality and new occasions. At the same time, we are creating new strategies that are winning over a massive new generation of teens to drive growth of Trademark Coca-Cola'.

Chief Financial Officer Gary Fayard commented 'The fundamentals of our business remain strong as we continue to gain market share globally and in key markets, expand our margins, and generate tremendous cash flows… We are confident that our 2020 Vision is achievable… our system and our Company are providing unmatched scale and reach, and our operations continue to generate strong and steady cash flows. We have a track record of returning cash to shareowners and diligently investing back into the business for profitable growth'.

The Coca-Cola Company is the world's largest beverage company, refreshing consumers with nearly 500 sparkling and still brands. Along with Coca-Cola, recognized as the world's most valuable brand, the Company's portfolio includes 12 other billion dollar brands, including Diet Coke, Fanta, Sprite, Coca-Cola Zero, vitaminwater, Powerade, Minute Maid and Georgia Coffee. Globally, we are the No. 1 provider of sparkling beverages, juices and juice drinks and ready-to-drink teas and coffees. Through the world's largest beverage distribution system, consumers in more than 200 countries enjoy the Company's beverages at a rate of nearly 1.6 billion servings a day. With an enduring commitment to building sustainable communities, our Company is focused on initiatives that protect the environment, conserve resources and enhance the economic development of the communities where we operate.

For more information about our Company, please visit our website at www.thecoca-colacompany.com. Stay informed. Subscribe to receive the latest news from The Coca-Cola Company at http://feeds.feedburner.com/NewsFromTheCoca-ColaCompany.

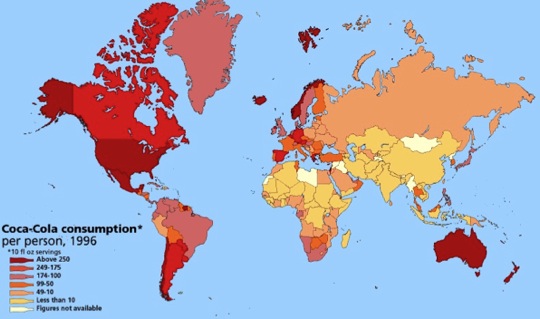

So how can this be achieved? Look at the map below. The data are 15 years old, but the pattern still more or less is apparent now. Countries which in those days averaged above 250 12 ounce 'servings' per person per year, are not the main target. The room for boom is in those countries shown as then consuming less than 100 servings a year. And that above all, means Asia and Africa. Will the strategy work? Well, obesity in China is rocketing, and currently about one-fifth of all the obese people in the world are Chinese. Nobody would suggest that the only reason is rocketing consumption of soft drinks. But would anybody suggest that the Coca-Cola road-map for winning together, now being laid down throughout lower-income countries, has nothing to do with the obesity pandemic? This seems unlikely.

Box 2

The soda wars. Is Pepsi in trouble?

The Wall Street Journal carried a story at the end of June on the decline in sales of Pepsi-Cola in the US. Here is an extract.

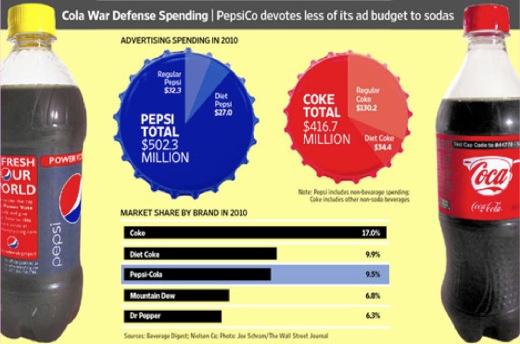

The snack-food and beverage giant is launching the first new advertising campaign for its flagship Pepsi-Cola in three years after it sank to No 3 in US soda sales last year, trailing not only Coke but Diet Coke.

When industry market share numbers came out in March, showing Pepsi-Cola slipped to No 3, analysts quickly accused PepsiC0 – and Chairman and Chief Executive Indra Nooyi – of taking their eyes off the company's biggest brand. Now, PepsiCo says it plans to spend about 30 per cent more this year on TV advertising for its North American beverages, with soda a big focus.

Hailed as a strategic visionary since taking PepsiCo's reins nearly five years ago, Mrs Nooyi is facing doubts from investors and industry insiders concerned that her push into healthier brands has distracted the company from some core products. She has set an ambitious goal of more than doubling revenue of nutritious products to $30 billion by 2020 while cultivating a corporate image tuned in to health and global social responsibility. Late last year, PepsiCo agreed to pay $3.8 billion to acquire a 66% share in Wimm-Bill-Dann Foods OJC, a leading Russian dairy products maker.

'Is she ashamed of selling carbonated sugar water?' said Pat Weinstein, an independent Pepsi bottler. 'That's a question that is raised often by the most concerned of the independent bottlers'. US sales of Pepsi-Cola and Diet Pepsi fell 4.8% and 5.2% in 2010. Coca-Cola and Diet Coke sales also slipped, though more modestly, 0.5% and 1%, respectively.

Products that PepsiCo calls 'good for you' still make up only about 20% of revenue. The bulk still comes from drinks and snacks the company dubs 'fun for you', including Lay's potato chips, Doritos corn chips and Pepsi-Cola, by far the company's single biggest seller with about $20 billion in annual retail sales globally. Some investors and PepsiCo bottlers say that Mrs. Nooyi has played down those products in her push to emphasize PepsiCo's health initiatives.

The company scaled back its earnings growth forecast earlier this year, blaming commodity prices and the global economic woes. It now expects earnings per share to rise by a high single-digit percentage annually rather than by the low double digits.

In an interview, Mrs. Nooyi acknowledged that she may have spent a disproportionate amount of time talking about healthier products, but said it's part of a 'deliberate strategy' to diversify the portfolio. Consumers increasingly want healthier foods and beverages, she said, and PepsiCo has to satisfy critics about health concerns.

In late 2008, Mrs. Nooyi turned her attention to North American beverages and a costly overhaul of all brands, as she said they were looking 'tired on the shelf'. PepsiCo launched new campaigns and graphics for all the big beverage brands and new packaging for more than 1,200 individual products, an unusually ambitious redesign.

Ad dollars for soda, however, were on the wane. As recently as 2005, PepsiCo spent $348 million on soda ads in the US, almost as much as Coke, which spent $377 million. But by last year, the company had more than halved its spending to $153 million, while Coca-Cola spent $253 million. Overall US advertising expenditure is shown in the graphic above.